Numbers That Prove the Case: Why Invest in a Food Factory?

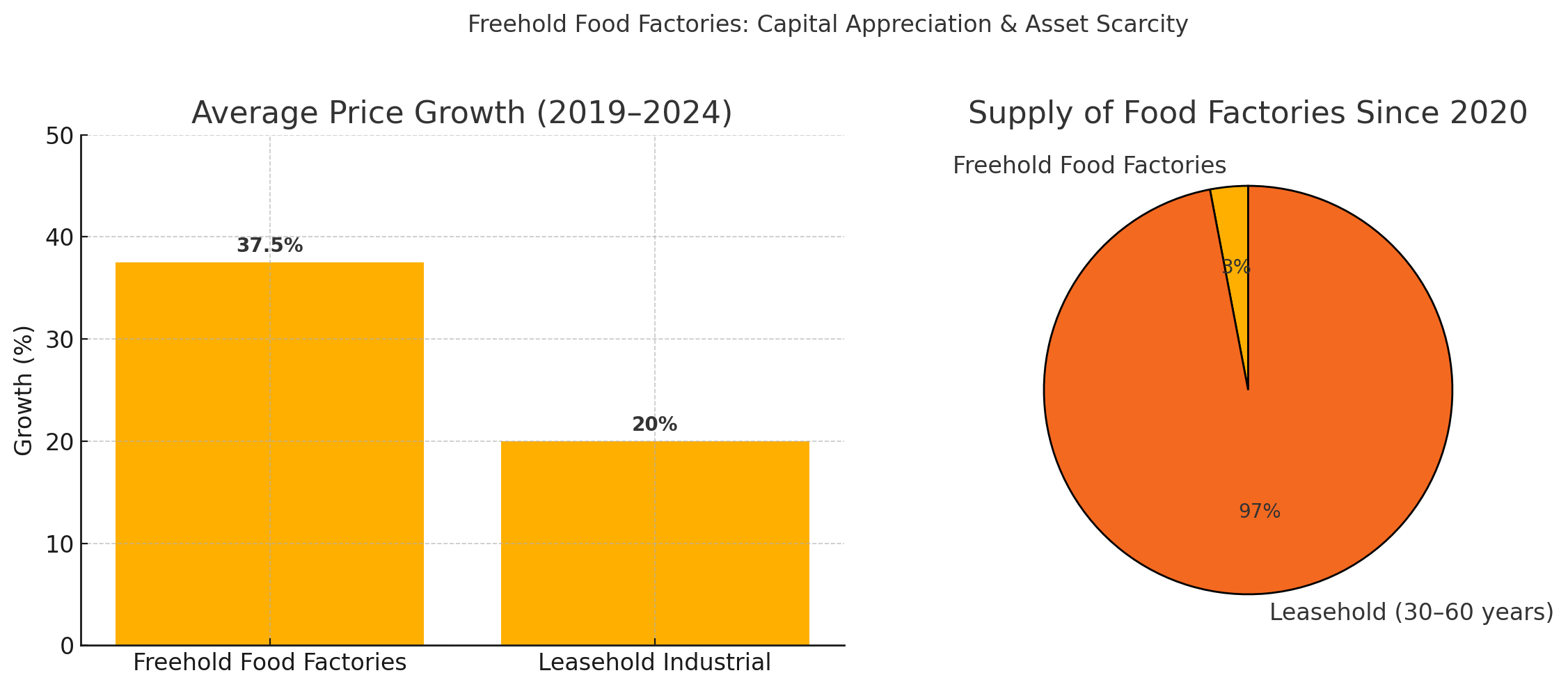

1. Capital Appreciation & Asset Scarcity

Freehold Food Factory Price Growth (Past 5 Years):

Average freehold food factory values have increased by 30–45% (2019–2024), compared to 15–25% for standard 60-year leasehold industrial units.Supply Rarity:

Out of ~1,100 industrial buildings launched since 2020, less than 3% are freehold food factories. The rest are mostly 30- or 60-year leasehold.

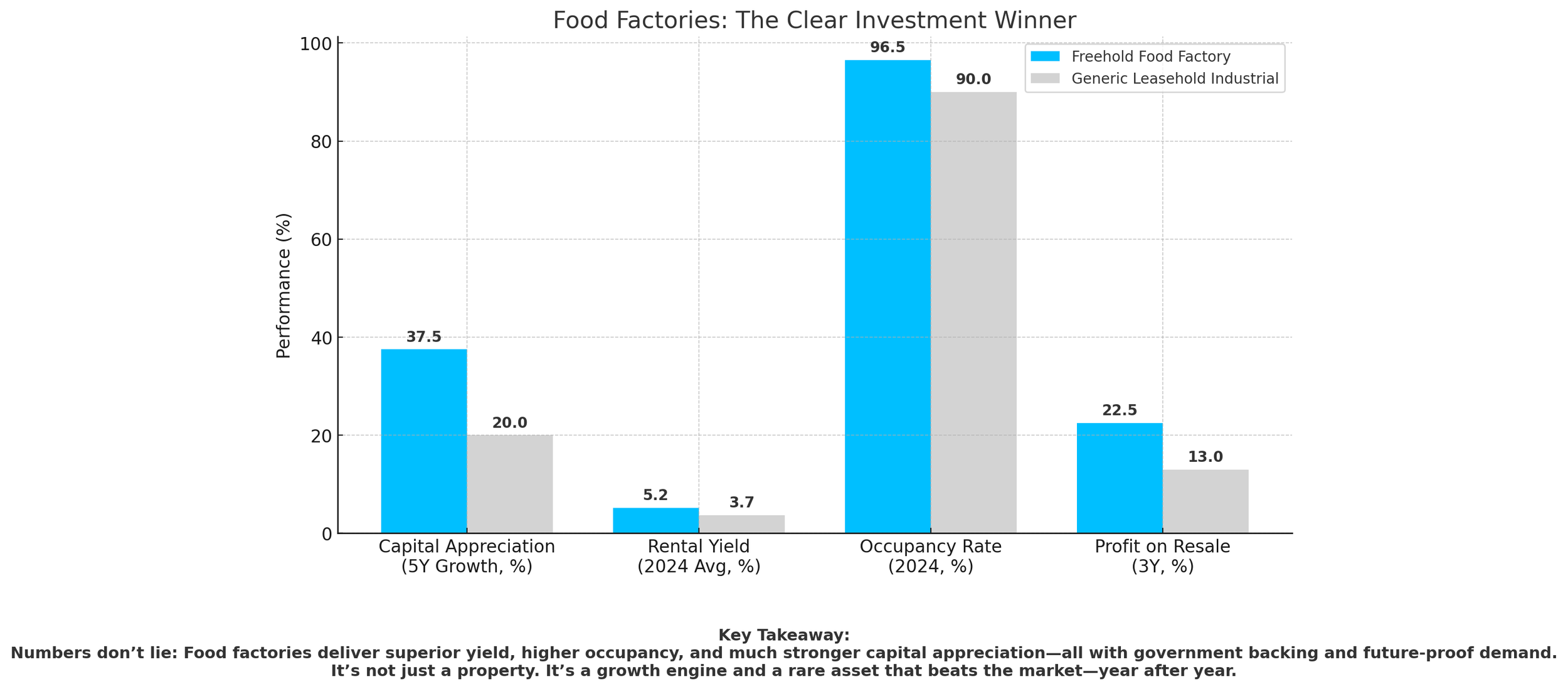

2. Rental Yield & Occupancy Advantage

Typical Gross Rental Yields:

Food Factory: 4.5% – 6.0% p.a. (2024 average; some premium units hit 6.5%+)

Generic B1/B2 Industrial: 3.2% – 4.2% p.a.

Occupancy Rates:

Food Factories: 95–98% (as of 2024, URA JTC data)

General Industrial: 88–92% (higher volatility during downturns)

Rental Premium:

Food factories command 10–30% higher rents per sqft due to compliance, specifications, and tenant scarcity.

3. Tenant Demand & Market Depth

Growing F&B & FoodTech Sectors:

+300 new food production businesses registered per year (2019–2024, ACRA/MOM data)

~60% increase in demand for central kitchens and food-tech facilities since 2021 (Enterprise Singapore, JTC)

Diverse Tenant Pool:

Includes central/cloud kitchens, food processing, cold-chain, exporters, and logistics operators—all classified as essential services.

4. Government Incentives & Support

Grants/Subsidies:

Food factory owners/tenants can tap Productivity Solutions Grant (up to 70% support), Enterprise Development Grant, and tax deductions for automation/digitalization.ESG/Green Building Value:

Modern food factories meeting green standards command a 5–8% premium in valuation and are more attractive to MNCs and export-driven tenants.

5. Resale Liquidity & Exit Potential

Resale Uplift:

Transactions for freehold food factories show higher resale liquidity, with some units achieving 20–25% profit on sub-sale within 3 years (JTC/URA caveats, 2020–2024).Exit Demand:

Institutional investors and private equity funds are now active buyers of food factories, driving up prices and ensuring a liquid resale market.